Earlier this month, the German Parliament voted to pass the "German Building Energy Act (GEG)", also known as the "Heating Act."

The bill stipulates that from 2024, Germany will gradually ban the use of traditional wall-mounted boilers and boilers as heating systems, promote the use of renewable energy, and require that each newly installed heating system must achieve at least 65% renewable energy contribution. Scale, for example, heat pumps and biomass boilers.

This also means that Germany's demand for heat pumps will rise, and China's heat pump industry is expected to usher in new development opportunities.

01

The German heat pump market is about to explode

We all know that in the past two years, the European energy crisis has become more serious. In particular, geopolitical tensions have led to many European countries that are highly dependent on natural gas energy to accelerate the pace of energy structure transformation. Germany, which imports about 90% of its energy from overseas, is one of them.

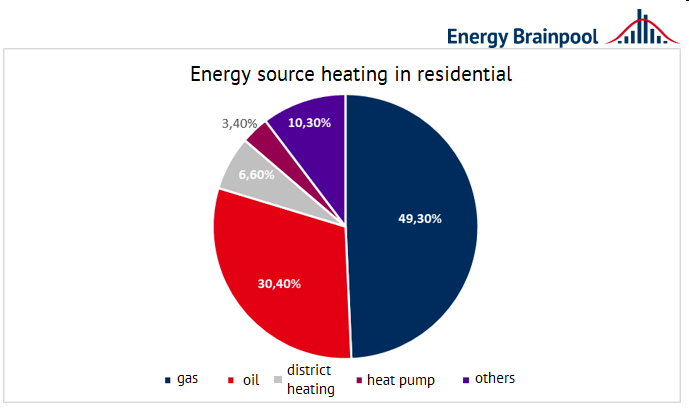

Looking at the structure of the heating industry for existing buildings in Germany, data from the industry association BDEW shows that there are about 18.9 million residential buildings in Germany. About 80% of this uses fossil fuels to meet heat energy needs.

In particular, natural gas occupies a dominant position of nearly 50% in the heating field; oil heating ranks second, accounting for about one-third; district heating accounts for 6.6%, and electricity, pellets, liquefied petroleum gas and coal heating systems account for 10.3%. %; heat pump heating only accounts for 3.4%.

The above figures show that Germany is currently heavily dependent on fossil fuels for heating, which means that Germany needs to import a large amount of oil and natural gas from abroad to meet the heating system, and both changes in import channels and energy price fluctuations will cause problems. It has a huge impact.

In order to promote the transformation of the energy structure and achieve the dual-carbon goal, Germany has accelerated changes in the heating field, and the heating bill is an important measure.

Relevant reports show that in the initial stage, this bill will only apply to new buildings within new residential development areas. Existing buildings and new buildings outside new development areas will gradually transition and will be valid until December 31, 2044. From 2045, Germany will completely ban oil and natural gas heating.

It is foreseeable that after the heating bill officially comes into effect, the demand for heat pumps in Germany will surge. In addition to new buildings, existing buildings will also consider sustainable heating solutions such as heat pumps when replacing heating equipment.

Thermondo's survey on the age structure of heating systems in existing residential buildings in Germany shows that many heating systems have reached the age of replacement. Among them, 12% have a service life between 21 and 30 years, and 5% have a service life of more than 30 years.

This means that many heating systems in Germany will be replaced within the next ten years.

02

Policy subsidies boost market demand

According to the heating bill, the German government plans to encourage people to renovate and switch to renewable energy heating systems through policies such as direct grants, loans and tax incentives.

![]()

All homeowners who install a climate-friendly heating system will receive a compensation of 30% of the purchase and installation costs; if the taxable household income is less than 40,000 euros (applicable to 45% of homeowners), an additional 30% subsidy will be added ; If it is replaced before 2028, an additional 20% subsidy will be available, with the total subsidy capped at 70%.

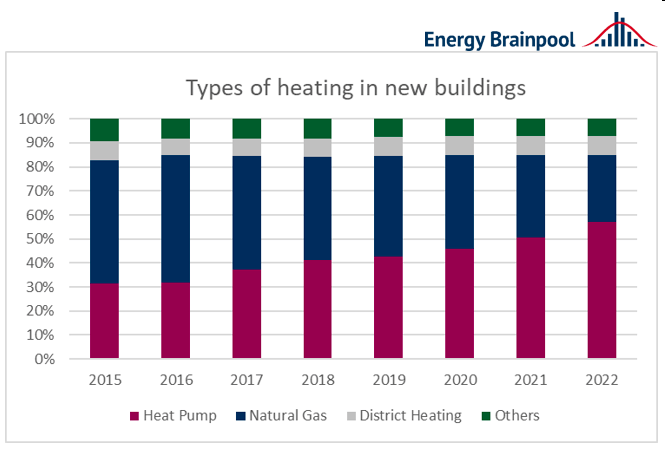

In fact, the demand for heat pumps in Germany has been on the rise in recent years. DESTATIS studied the installation of heating systems in Germany from 2015 to 2022 and found that new natural gas installations are declining rapidly and the proportion of heat pumps is steadily increasing.

By 2022, 57% of new buildings will have heat pumps installed. In contrast, the share of natural gas heating systems has been declining, from 52% in 2015 to 28% in 2022. This reflects the increasing popularity of heat pumps in new construction.

Overall, the German Heat Pump Industry Association estimates that 230,000 new heat pumps will be installed in the country in 2022, and 350,000 new heat pumps are expected to be installed in 2023, a year-on-year increase of 52%.

Since heat pumps use clean electricity, have higher heating efficiency, and have environmental protection and economic advantages, the German government hopes to upgrade heat pumps to the largest heating system and plans to install 500,000 new heat pumps every year from 2024. By 2030, the market share Reached 6 million units.

As of the end of last year, the annual production capacity of the entire industry in Germany was only 150,000 units, and the waiting time for product delivery has reached 6 months to a year. The German Heat Pump Industry Association stated that the shortage of raw materials and skilled workers may slow down the growth rate.

However, relevant reports show that the German Bosch Group Heating Technology Company has set a growth target of 35% to 40% and plans to invest 300 million euros in 2025 to focus on promoting the research and development and industrialization of heat pumps.

![]()

03

Chinese heat pump companies will welcome international market opportunities

It can be seen from the above that due to the impact of supply, the German heat pump market may become more dependent on imports, while China is the main producer and exporter in the global market.

Statistics from the General Administration of Customs of China show that from January to November 2022, China's air source heat pump export volume increased by 21.8% year-on-year, and the export value increased by 56.5% year-on-year. The export destinations were mainly concentrated in France, Italy, Germany, the United Kingdom, Spain and other places.

It can be seen that the demand for air source heat pumps is increasing not only in Germany, but also in European countries in 2022. Data from the European Heat Pump Association shows that in 2022, heat pump sales across Europe will be close to 3 million units, an increase of nearly 40% over the previous year.

In addition to the import and export between EU countries, China is the largest import trading partner of heat pump products in the EU countries. The prosperity of the European heat pump market will bring good opportunities to Chinese related companies. Relevant market forecasts show that the average annual size of the new heat pump market in Europe from 2023 to 2030 is approximately 421.6 billion yuan. In 2030, the domestic heat pump market is expected to reach 106.8 billion yuan, of which domestic sales/sales to Europe/sales to the rest of the world are 328/782/3.6 billion yuan respectively.

Shoptop Market Insights

Shoptop independent station brand overseas experts believe that the surge in demand for heat pumps in Germany and the entire European market will bring benefits to all links of China's heat pump industry chain.

Traditional domestic manufacturers, represented by Haier and Midea, are relatively mature in technology and have brand and channel advantages, and are expected to become leaders in the overseas expansion of brands; while companies that combine export OEMs with domestic sales of their own brands are It can be the first to achieve an explosion of orders, and can rely on its own brands to enter overseas markets and increase profit margins; upstream parts manufacturers can quickly increase their market share by relying on cost advantages and domestic substitution logic.